Tax Insights

Explore expert blogs, guides, and advice tailored for small business owners and individuals.

Social Security Tax Relief: How the One Big Beautiful Bill Act Changes Your Retirement Income

The One Big Beautiful Bill Act has sparked confusion about Social Security taxation changes. We cut through the myths to explain what the proposed "senior deduction" really means for your retirement taxes and who actually benefits. Learn more.

5 Common Tax Mistakes High-Income Professionals Make — And How to Avoid Them

High-income professionals often leave thousands on the table due to preventable tax mistakes. From overlooking retirement plan limits to poor entity structure choices, these costly errors can significantly impact your wealth. Discover five common pitfalls and actionable strategies to maximize your tax savings.

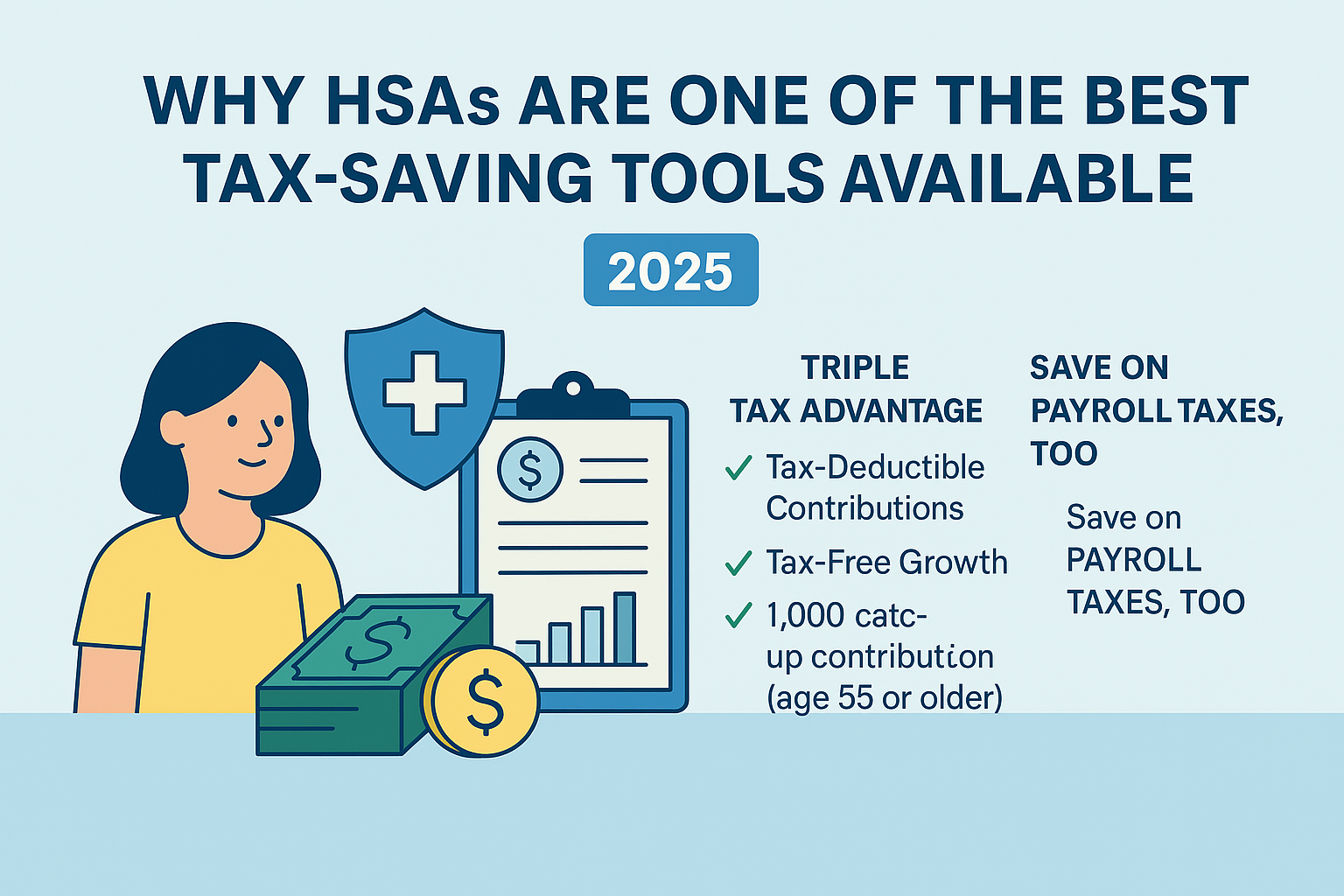

Why HSAs Are One of the Best Tax-Saving Tools Available in 2025

In 2025, Health Savings Accounts (HSAs) offer up to $8,550 in tax-deductible contributions, plus triple tax benefits: tax-free growth, withdrawals, and payroll tax savings. Learn why HSAs are a smart move for your health and your finances.