Tax Insights

Explore expert blogs, guides, and advice tailored for small business owners and individuals.

Are You Overlooking These 4 Federal Tax Breaks for 2025?

Could you be missing out on significant savings this tax season? Discover four federal tax breaks for 2025 that could lower your bill, including a generous SALT deduction, relief for overtime earners, a car loan interest write-off, and special deductions for seniors. Don’t leave money on the table—read on to learn more!

Taxpayer Bill of Rights: What Every Taxpayer Should Know

Understanding your taxpayer rights is key to fair treatment by the IRS. The Taxpayer Bill of Rights outlines protections, from privacy to representation, empowering you to handle tax matters confidently. Learn how these rights work for you—explore the full guide today!

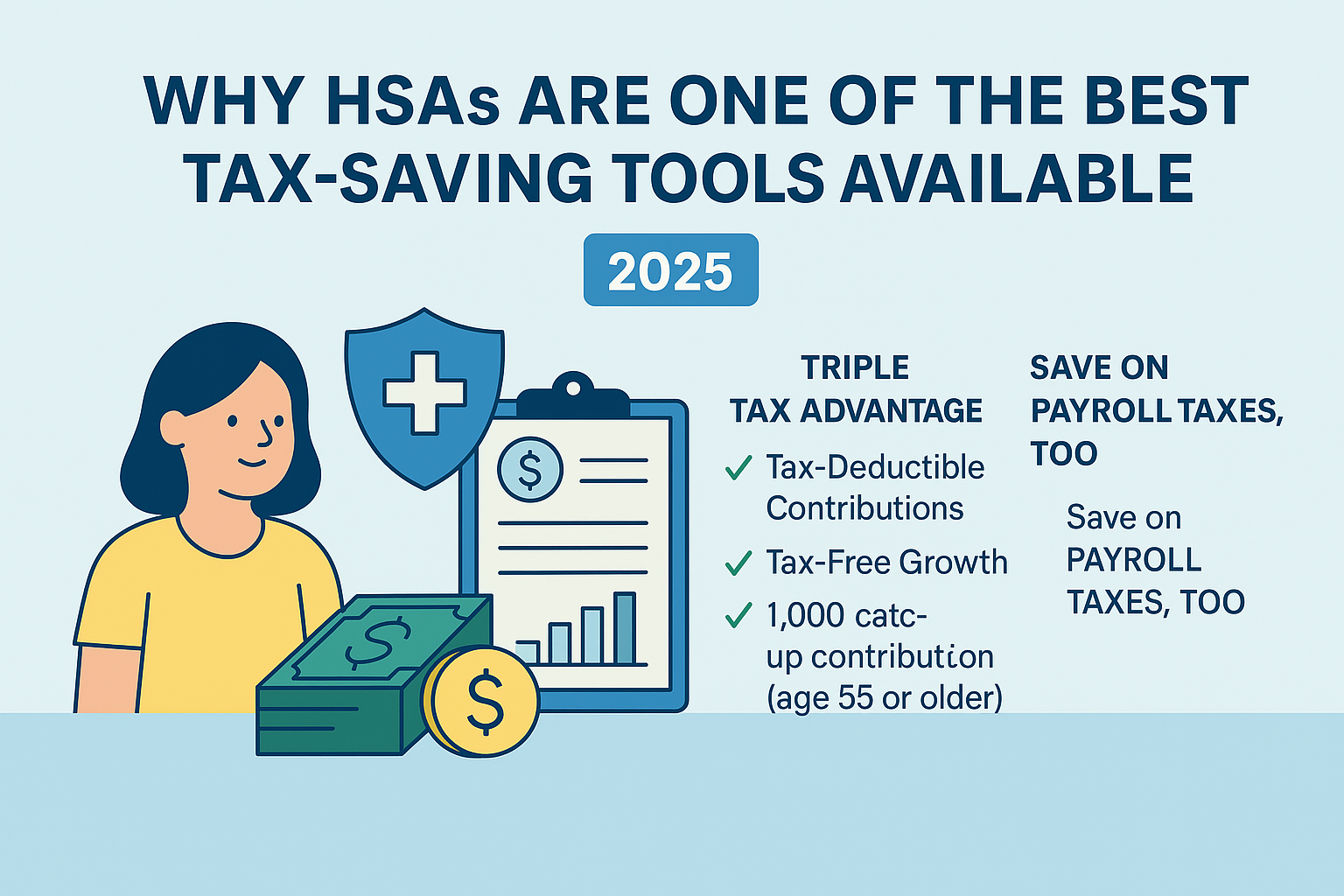

Why HSAs Are One of the Best Tax-Saving Tools Available in 2025

In 2025, Health Savings Accounts (HSAs) offer up to $8,550 in tax-deductible contributions, plus triple tax benefits: tax-free growth, withdrawals, and payroll tax savings. Learn why HSAs are a smart move for your health and your finances.