Tax Insights

Explore expert blogs, guides, and advice tailored for small business owners and individuals.

Should Your Small Business Elect S Corporation Taxation?

Struggling with tax complexities as a small business owner? Discover the pros and cons of electing S corporation taxation, including potential tax savings and key insights for businesses with real estate holdings. Learn when an S election makes sense and how it could benefit your bottom line. Read more to make informed decisions today!

Tax Planning Tips for New Business Owners

Struggling with tax planning as a new business owner? This guide breaks down essential tips to help you stay compliant, maximize tax savings, and avoid costly errors. Whether it's understanding deductions or keeping accurate records, we’ve got you covered. Read on to take control of your taxes with confidence!

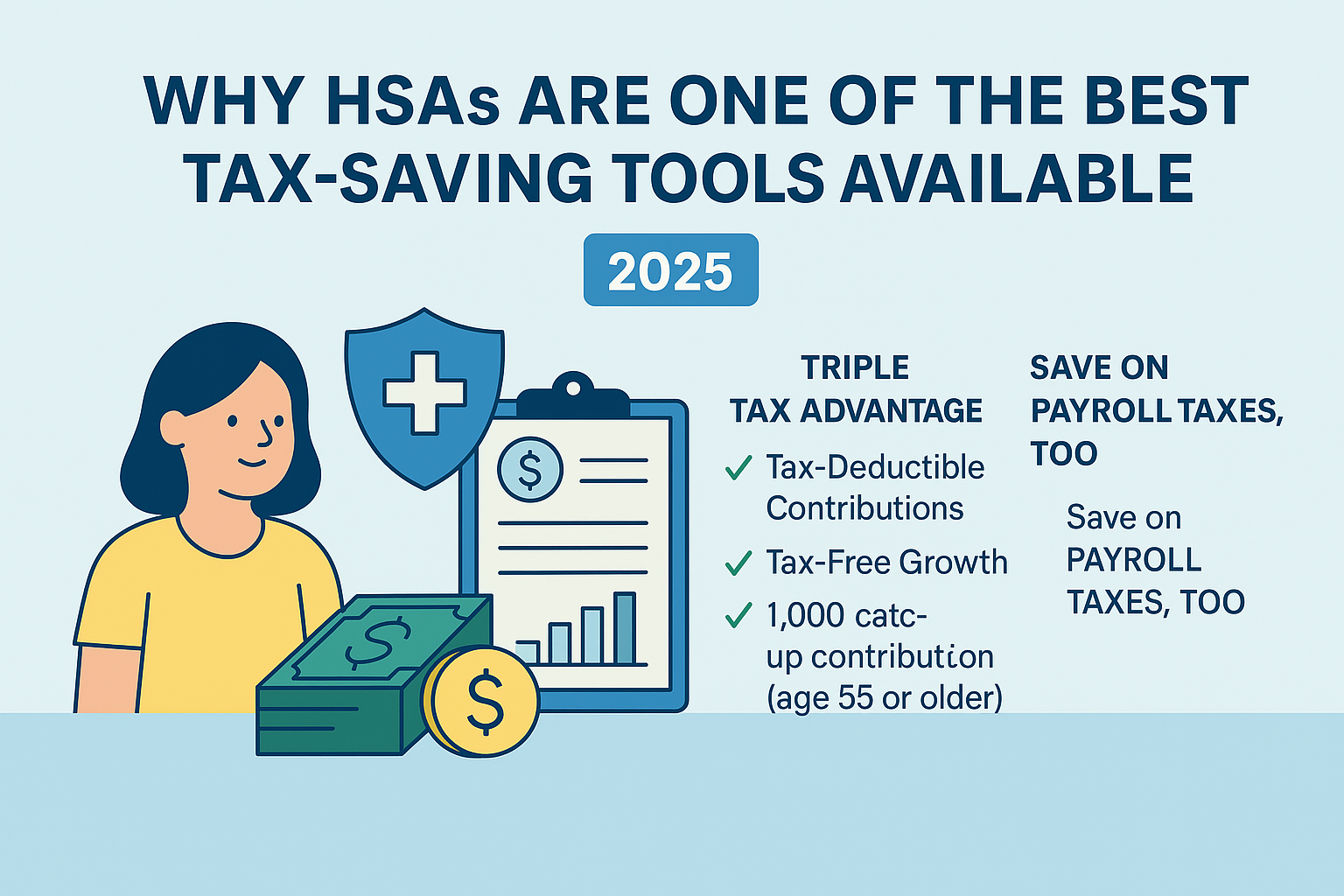

Why HSAs Are One of the Best Tax-Saving Tools Available in 2025

In 2025, Health Savings Accounts (HSAs) offer up to $8,550 in tax-deductible contributions, plus triple tax benefits: tax-free growth, withdrawals, and payroll tax savings. Learn why HSAs are a smart move for your health and your finances.